ct sales tax exemption form

Request for Taxpayer Identification Number TIN and Certification. Individual Tax Return Form 1040 Instructions.

Ohio Farm Sales Tax Exemption Form Tax

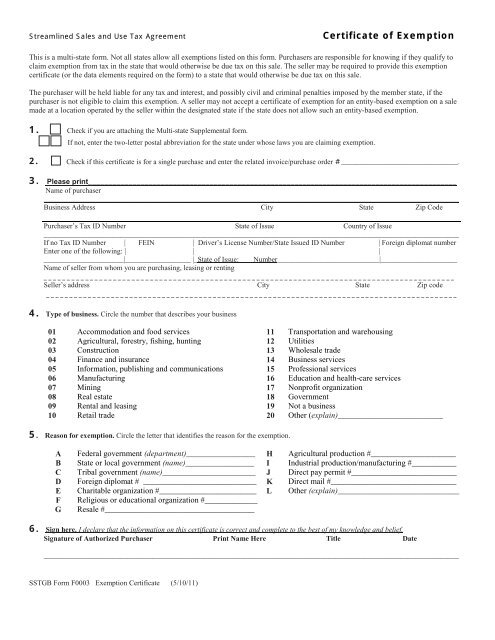

Sales Use Tax Exemption Form CRT-62 or Uniform Sales Use Tax Exemption Form Indiana Form ST-105 or Streamlined Sales Tax Agreement Certificate of Exemption.

. A tax exempt certificate is issued to an entity that qualifies for an exemption or because the purchased item qualifies for the exemption. Cert 119 501c3 letter. The threshold of sales activity needed to establish salesuse tax economic nexus may differ by state.

License from CT Department of Health Form CERT-113 IRS 501c3 letter Farmer Tax Exemption Permit Form CERT-100 or Form CERT-101 or Form CERT-108 Partial or Form. The Ridgefield Assessors office is accepting applications from qualified homeowners for the Town Program for Tax Relief from January 1 2022 through April 1 2022. Request For Data Mailer SCRA Non-Resident Active Duty MV Exemption CT Resident Active Duty MV Exemption - SITUS Tax Exempt Organization Application and Quadrennial Renewal and Wheelchair MV.

New Connecticut Residents - New Connecticut residents are not required to pay sales tax if the vehicle was registered in the same name in another state for at least 30 days prior to establishing Connecticut residency. 2022 Town Revaluation Project Press Release. You must complete section 6 if tax exemption is claimed on the Application for Registration and Title.

The exemption does not apply in any. Present sales use tax exemption form for exemption from state hotel tax. Sales Subject to Stadium Sales Tax Step C Sales Tax Before Discount 17 Total sales tax add TAX amounts from lines 8 14 15b and 16b.

CT-332-I Instructions Life Insurance Company Guaranty Corporation Credit. South Carolina SC x No Exemption based on the status of the purchaser. Transfer or Sale Between Immediate Family Members.

Employers must use the tax form that corresponds to the tax return previously filed to make an adjustment or claim a refund or abatement of FICA tax RRTA tax or income tax withholding. In order to qualify. If you are selling to a purchaser who is not required to hold a sellers.

You must be 65 years of age or older by December 31 2021. For more information please see Sales for Resale Publication 103. Proof is generally provided in the form of an exemption certificate that meets that state.

Access Owners Certification Form a Workers Compensation Coverage Affidavit Certificate of Liability Insurance and Non-Owners Affidavit. CO DR-0563 MJ Form State Sales Tax License City License if app Connecticut. Multi-JurisdictionResale Cert Sales Use.

Sales and Use Tax Exemption for Purchases by Qualifying Governmental Agencies. Public - Cert 134 Private - Cert 119 501c3 letter. 17 Check if business discontinued enter discontinuation date below MM DD YYYY To report county sales tax for more than 4 counties leave lines 9-12 blank and complete and enclose Schedule CT.

Or sales of fuel during the income tax year. Friday through midnight Saturday. A Buyer has salesuse tax nexus in a state if the Buyer has physical presence in that state or has made sufficient sales to customers in that state to have salesuse tax economic nexus.

Instructions for Form 1040 Form W-9. Claim for Retaliatory Tax Credits. Non-Life Insurance Corporation Franchise Tax Return.

Limited items are exempt from sales tax. Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut Provision. No sales tax or local option sales tax will be collected on sales of an article of clothing or footwear having a selling price less than 10000.

Also see Life Insurance Company Guaranty Corporation credit CT-34-SH. Contractors Exempt Purchase Certificate for a Renovation Contract with a Direct Payment Permit Holder. Many non-contractor businesses are surprised to learn during a state tax audit that what they thought was a nontaxable construction contract is actually considered by Pennsylvania to be a purchase of tangible personal property TPP with.

1 Some businesses are not required to hold a sellers permit for example a business may not make sales in this state or it may not sell property that is subject to sales tax when sold at retail. Also use Form 4136 if you are a producer claiming a credit for alcohol fuel mixtures or biodiesel mixtures. Exemption extends to sales tax levied on purchases of restaurant meals.

Sales tax exemption certificates are required whenever a seller makes a sale of taxable goods or services and does not collect sales tax in a jurisdiction in which they are required to. One must research the various tax department web sites or consult with their SALT advisor to determine which form applies. Multi-JurisdictionResale Cert Sales Use Tax Permit.

If the Buyer is entitled to claim a resale sales tax. CT-331-I Instructions Claim for CAPCO Credit. C O U N.

A resale certificate cannot be used to purchase items exempt from sales tax that do not qualify for this purpose. State-Issued Farmer Tax Exemption Permit. CREDIT FOR PERSONS 65 OVER.

Whether or not you are a construction contractor the sales and use tax rules regarding this industry affect you. State government websites with useful information for tax-exempt organizations including registration requirements for charities taxation information for employers and more. Cert 119 501c3 letter.

South Dakota SD No reciprocity with State of Vermont per 1-800-TAX-9188.

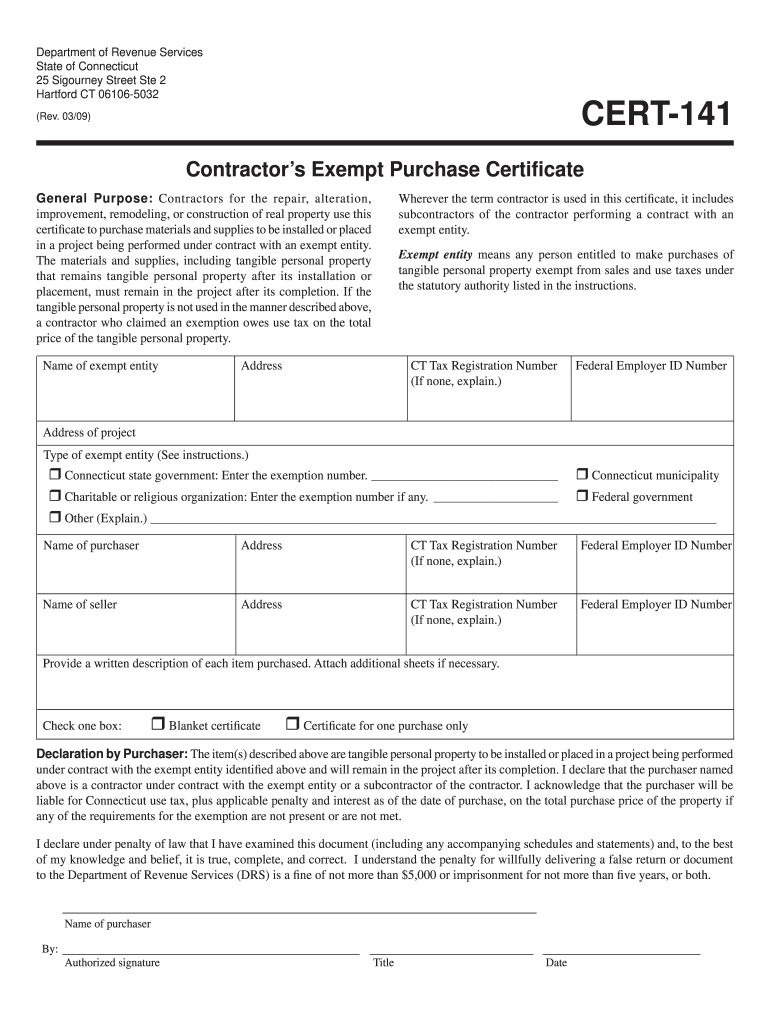

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

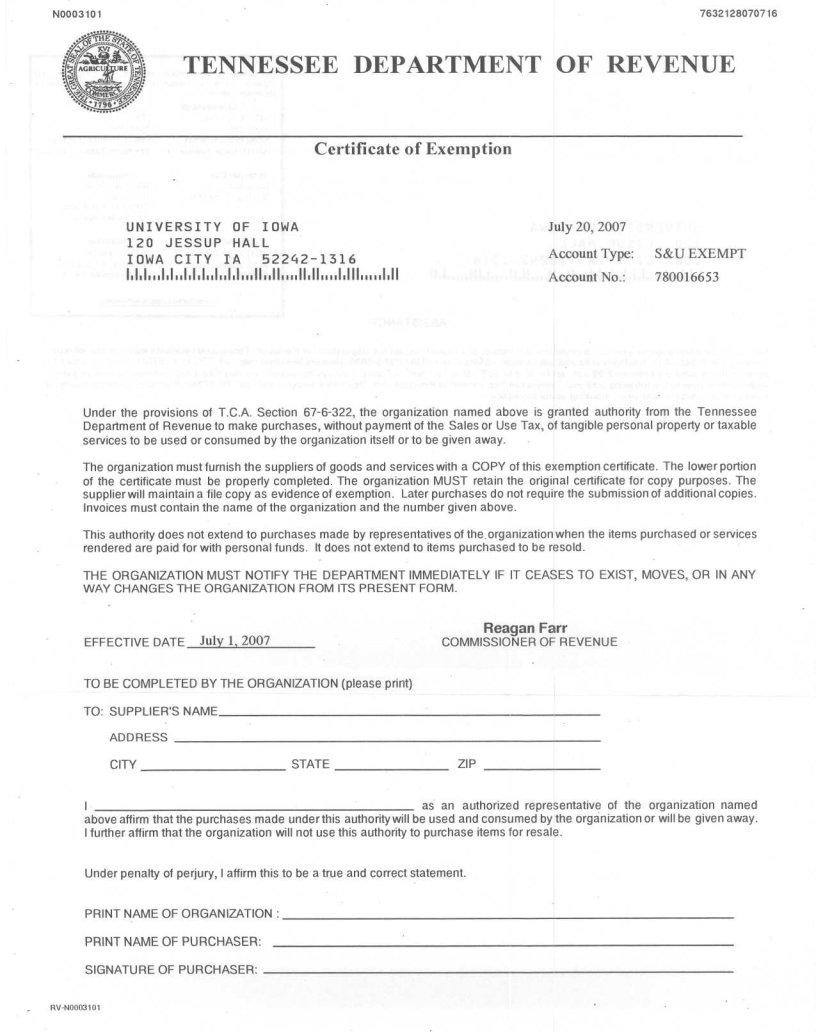

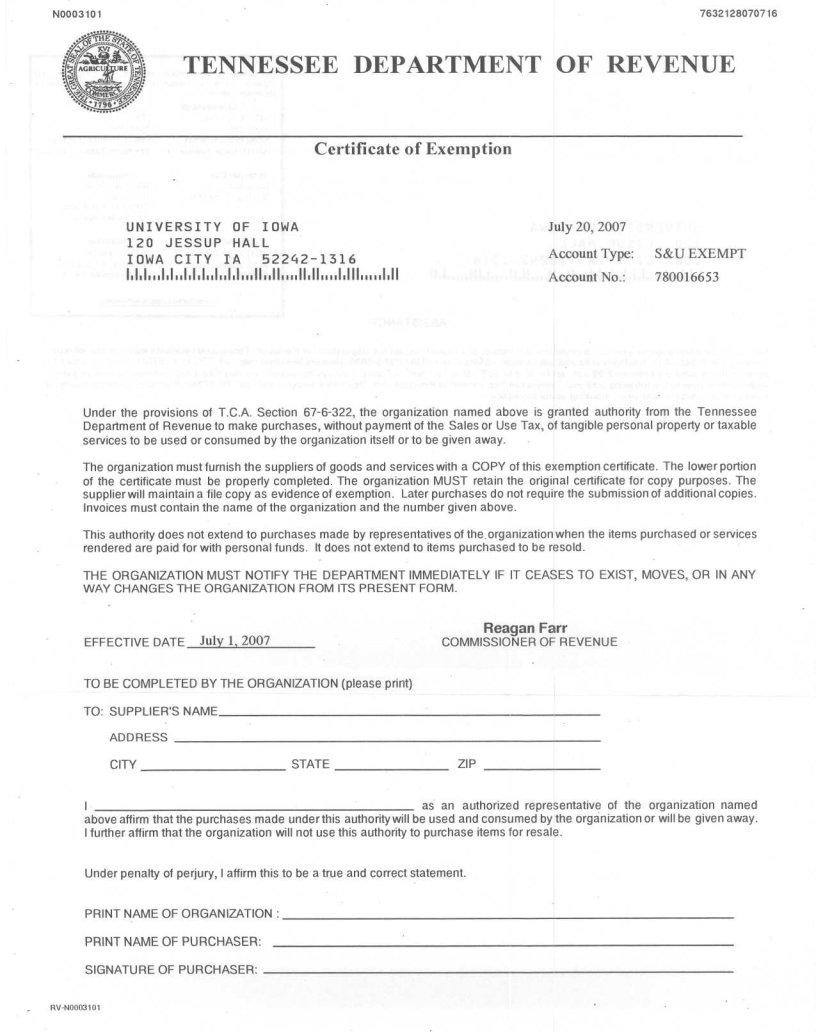

Tennessee Exemption Certificate Fill Out Printable Pdf Forms Online

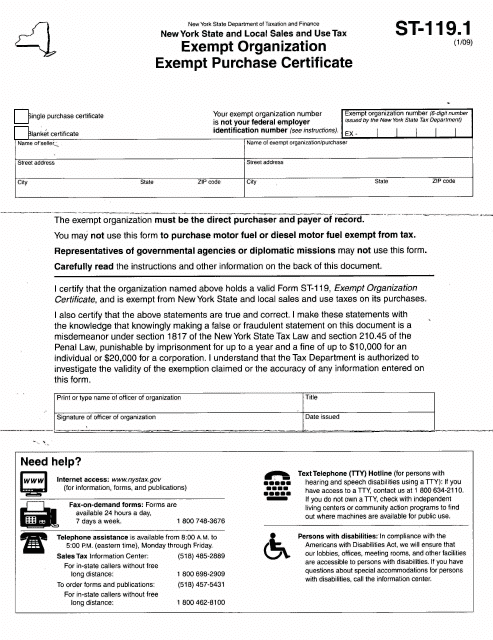

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

Streamlined Sales And Use Tax Agreement Certificate Of Exemption

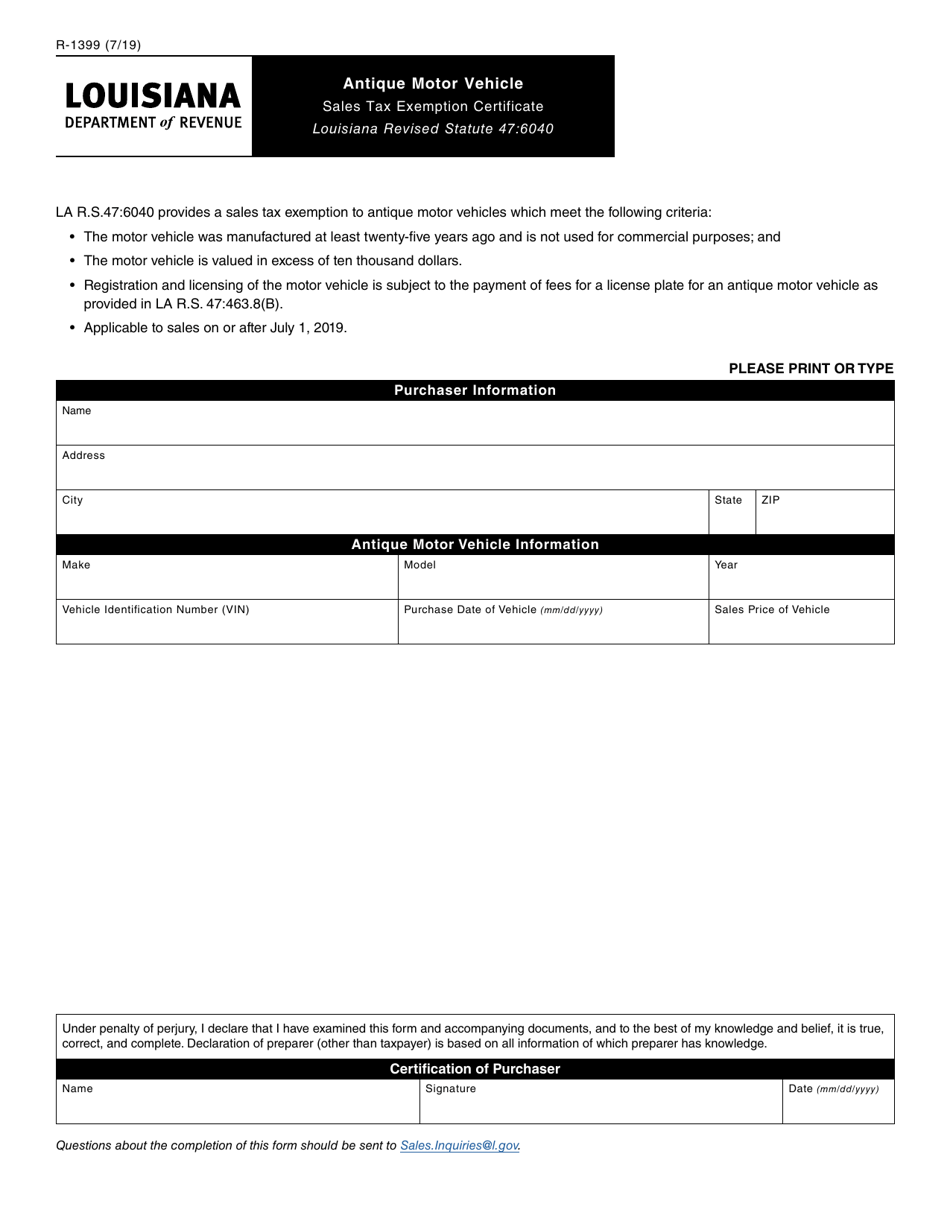

Form R 1399 Download Fillable Pdf Or Fill Online Antique Motor Vehicle Sales Tax Exemption Certificate Louisiana Templateroller

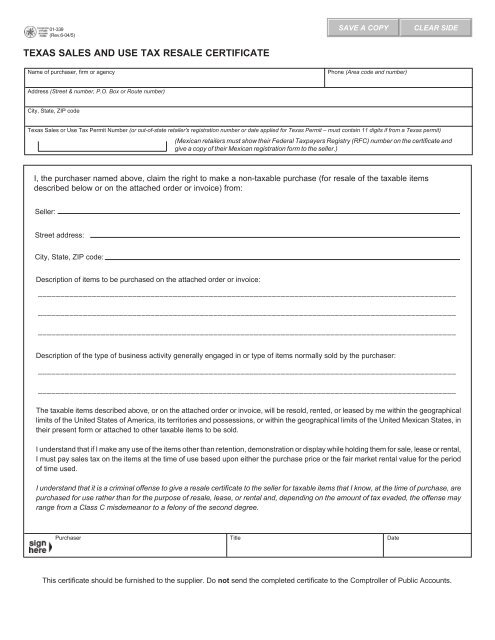

Businessusetaxexemptform Motion Raceworks

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

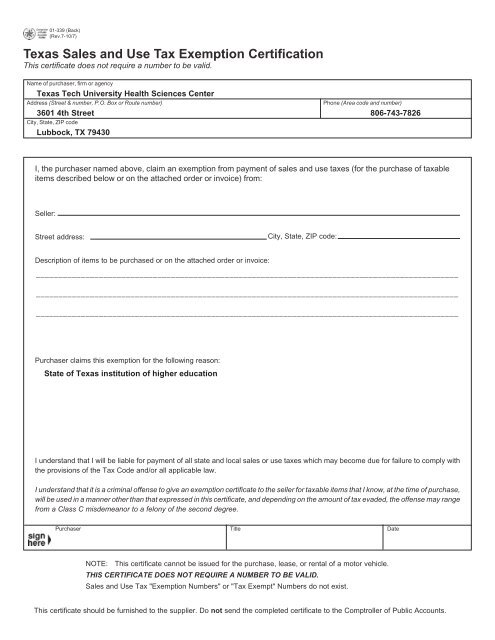

Texas Sales And Use Tax Exemption Certificate

Texas Sales And Use Tax Exemption Certification Texas Tech

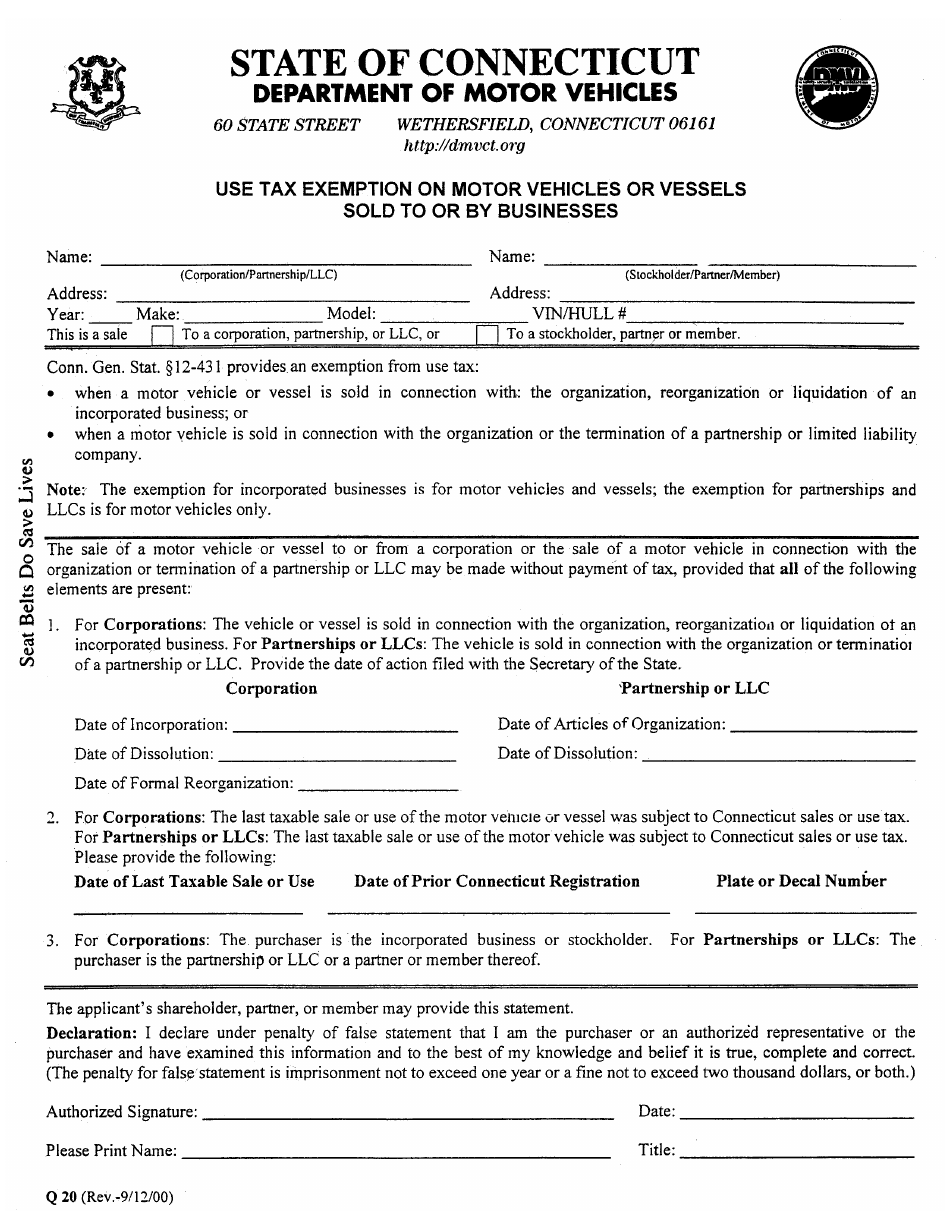

Form Q 20 Download Fillable Pdf Or Fill Online Use Tax Exemption On Motor Vehicles Or Vessels Sold To Or By Businesses Connecticut Templateroller

Sales Tax Exemption For Building Materials Used In State Construction Projects